What’s a payday advance app in Australia?

Last updated on August 27th, 2024

Pay on demand applications such as MyPayNow and Beforepay are designed to provide access to a portion of earned but unpaid wages before your official payday. Like payday loans, payday advance apps in Australia offer a safety net if you’re caught short unexpectedly.

Unlike payday loans, however, they are generally a cheaper and safer short-term fix, as they provide short-term cash advances based on your earned income and typically charge a flat fee of 5 percent of the amount you’re borrowing. Some operate with a voluntary tipping system, or a small subscription fee and you may also be charged a fee if you do not repay the amount advanced on time.

Since these apps base their services on your earned income and directly connect with either your bank account or employer, most do not require a credit check. Additionally, repayments are generally automatically deducted from your next pay cheque, which can simplify managing your finances.

With $3.2 billion advanced in 2022, the market is growing rapidly and not everyone is happy about it, in part because the industry is so new it’s not as regulated as other forms of lending.

Who offers pay advance apps in Australia?

There are three different ways to obtain pay advance apps in Australia – through a third-party company such as MyPayNow and Beforepay, your employer, or your bank.

Third-party apps are generally accessible to a wide range of users in Australia. They do not need to contact your employer and payments are usually instant but may take a few days to appear in your bank account. With MyPayNow you can advance up to a quarter of your wage for a 5 percent fee, while Beforepay will charge the same fixed fee for up to $2000 depending on what you get paid.

Employer-sponsored programs, such as Earnd, are directly integrated with the company's payroll system and may come with lower fees or even be free for employees. Withdrawals are then deducted from your next pay before you receive it.

Bank-provided wage advance services, such as CommBank AdvancePay, offer the advantage of being associated with trusted financial institutions and may have additional financial assistance available.

While the features and fees of pay advance apps in Australia vary from one provider to another, there are some common elements, according to PressPay:

-

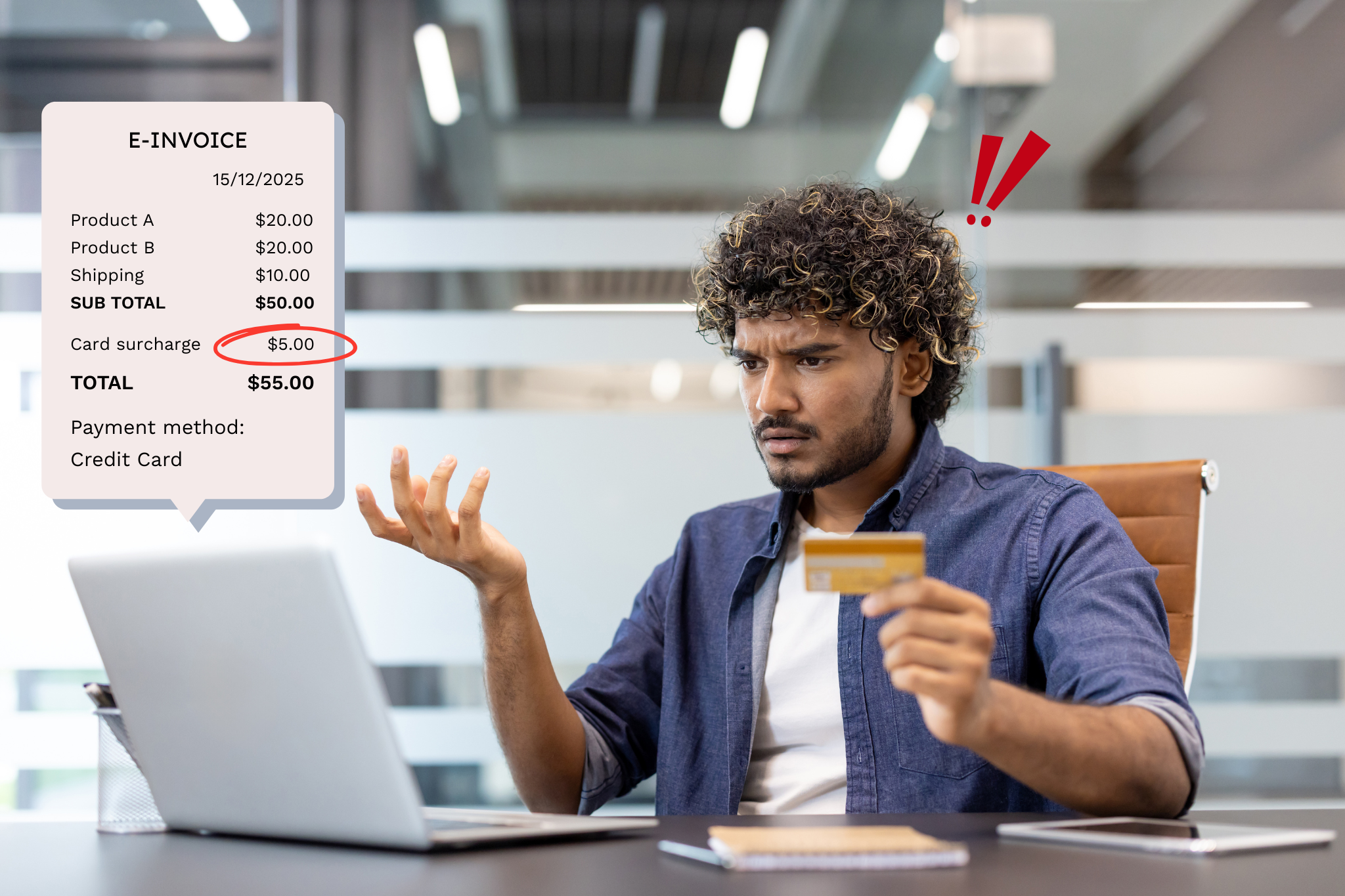

- It’s often cheaper than other types of short-term loans - Pay advance apps generally have a flat fee of around 5 percent per transaction. However, this only remains affordable if you're able to make timely repayments; otherwise, additional fees and interest can quickly add up.

- Same-day money access - One of the key selling points of wage advance services is the quick access to funds. Many providers complete the money transfer within minutes, giving you the immediate relief you seek.

- Automatic deductions - To simplify the repayment process, the borrowed amount is automatically deducted from your bank account once you receive your next pay cheque, or taken out of your salary by your employer before you get paid. This means you don't have to worry about remembering to make the payment yourself.

- Fewer credit checks - Many payday loan providers do not conduct credit checks, so a poor credit history is not necessarily an impediment. This can be a blessing and a curse, as it gives access to funds when other options are unavailable, but it can also lead to taking on debt without fully understanding the risks involved.

Are wage advance apps regulated in Australia?

These apps do not fall under the same regulatory framework as traditional lenders, as they do not typically lend money in the same manner. However, payday advance apps in Australia are still subject to general consumer protection laws and financial regulations.

The Australian Securities and Investments Commission (ASIC) is the regulatory body responsible for overseeing the financial services industry, including some aspects of wage advance apps. ASIC's regulatory purview extends to ensuring that these services comply with consumer protection laws, disclosure requirements and fair business practices.

Some wage advance apps in Australia may also be required to hold an Australian Financial Services (AFS) licence, depending on the specific services they provide. For instance, an app offering financial advice or dealing with insurance products would need an AFS licence.

While no specific regulation is tailored exclusively for wage advance apps, the Australian government and regulatory bodies are closely monitoring the sector as it evolves, and many are calling for a crackdown.

What's the reputation of payday advance apps in Australia?

Pay advance apps provide a more affordable and convenient way to access earned wages before payday, helping to cover unexpected expenses or financial emergencies. They also have lower fees compared with payday loans and promote more responsible borrowing by limiting the amount that can be advanced. Some even offer financial tools such as budgeting assistance or savings features, which can help users manage their finances more effectively in the future.

However, you should always explore alternatives to payday loans of any kind, including wage advance apps. Critics argue they can still lead to a cycle of debt if used irresponsibly or relied upon too often. These apps might normalise borrowing from future earnings, potentially causing users to become dependent on the service and struggle with long-term financial stability.

As always, if you have a complaint about one of the pay advance apps in Australia, lodge a complaint with us, and we’ll help you handle it.