#TravelAdventures await – tips on keeping your travel money safe during COVID

Last updated on July 22nd, 2021

We all have our dream travel destinations in post COVID times. Due to the abrupt halt to travel, many of us have money stored in foreign currency and on travel cards. We’re trusting our travel money is safe until we can travel again. However there are some recent changes affecting travel money.

Keeping up-to-date on changes affecting travel money will save you from being disappointed and out-of-pocket. Taking some small steps today may save you a lot of hassle in the future when you attempt to use your hard-earned money.

We’ve compiled our ideas and recent news so you can stay on top of your travel money.

Exchanging foreign currency

If you have money stored in foreign currency, it’s not a good idea to exchange small amounts of currency as you’ll lose a lot of money in the exchange rate.

However if you do have a substantial amount of a single currency, it’s worthwhile keeping an eye on the exchange rate. We’re seeing a decent amount of currency fluctuations to make the effort worth your while.

Velocity Global Wallet winds down

Virgin Australia’s frequent flyer program is called Velocity. Since July 2013, Velocity has offered a product called Velocity Global Wallet, a prepaid Visa card that allowed members to load up to 11 different currencies onto a single card. The cards were designed to be used overseas for transactions in foreign currency. The Velocity Global Wallet is currently part of most Velocity member cards. Velocity, the frequent flyer program is continuing, but Global Wallet is winding down.

Don’t actually cut up your Global Wallet card because it’s also your Velocity membership card which you might need one day for lounge access and the like.

If you’ve never loaded money onto your Global Wallet card, there’s no need to take action. If you have funds in a Velocity Global Wallet you do need to take action.

From 1st February 2021 you’re no longer earning Velocity points on your transactions and the following fees apply:

- $2 to withdraw funds via an ATM,

- $2 for a balance enquiry via an ATM, and

- $10 to transfer funds to a nominated bank account.

If you have regular payments coming out of the card, like recurring subscriptions and bills, switch these to another account to prevent overdue fees or cancellations.

You won’t be able to make any transaction from 1 August 2021 so it’s best to withdraw your remaining funds now. If you don’t take any action, an inactivity fee 0.5% of the amount on the card will be charged if no there’s activity for 12 months. After 7 years, unclaimed funds will be transferred to an unclaimed monies fund.

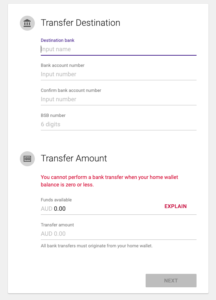

Steps to withdraw funds from your Velocity Global Wallet

- Go to https://velocityglobalwallet.com/

- Login with your Velocity Frequent Flyer number as your Global Wallet Username

- Reset your password if required

- Click on the “Transfer” option

- Complete the form with bank details where you want the money transfer to (Transfers need to be manually by you into a bank account)

You can contact their support team through 131875 or +61 2 8667 5924 (Select Option 2 then Option 3) or [email protected].

Travel money cards

It’s approaching 12 months since travel restrictions were imposed due to the pandemic. While each travel money card has different terms and conditions, as explained with the Velocity Global Wallet, some cards will start charging inactivity fees. The Travelex Money Card card has a monthly inactivity fee of $4 after 12 months without use. So, now is a great time to check on any travel money cards you may have.

Factors to consider when deciding if it’s better to withdraw funds and close the account:

- Can you make good use of the money in the account? Paying off a credit card accruing interest is an example of this.

- Will your card expire before you can use it?

- What are the inactivity fees?

- Can you prevent inactivity fees?

- Are there ATM withdrawal fees if you use the card in Australia?

- What are the fees to close the account?

- What are the fees to reload your card?

- Is the exchange rate fixed for the existing money on the card? If so, how does the exchange rate you received when loading the travel money card compare with today’s exchange rate.

- What are the likely foreign currency trends for the future?

Use the tips above to consider if it’s wiser to withdraw remaining funds and close the account or to keep it for your next vacation.

And just remember, if you can’t access money stored in travel cards, we’re here to help you resolve the issue, dodgy policy or otherwise.

You can tell us what’s gone wrong and what it’ll take for you to become a satisfied account holder. Just say the magic words 'Help Me Handle It'.