Broken promises: Are you eligible for an insurance refund?

Last updated on May 29th, 2025

Did you know that you could be in line for an insurance refund of up to $290? The Australian Securities and Investment Commission (ASIC) has discovered that over 5.6 million consumers have been overcharged by insurers, amounting to a total of $815 million.

An ASIC investigation has spotlighted 11 general insurers, which encompass dozens of subsidiaries or brands. These companies misled consumers about pricing discounts. Essentially, these insurers failed to deliver the promises they made to lure new clients or retain existing ones.

And the regulator is taking action over the breaches. According to ASIC Deputy Chair Karen Chester, “We have already commenced related civil penalty proceedings against two insurers, in 2021 and 2023, and we have further investigations underway,”

Insurance Australia Limited (IAL) received a $40 million penalty from the Federal Court for failing to honour discount promises made to customers who held NRMA branded insurance policies. It is the largest ever penalty imposed by the Court against an insurer for breaches of the financial services consumer protection laws. IAL is part of Insurance Australia Group (IAG) and includes well-known brands such as Coles Insurance, NRMA and SGIO.

Also under the spotlight is major insurer, RACQ. It is expected to repay up to 500,000 members a total of $220 million, averaging $290 per policy.

So what does this all mean for you?

Where it all began

This investigation stemmed from various incidents spanning several years. Breach reports from 2018 to 2021 highlighted significant pricing misconduct. Although ASIC issued public warnings in 2013, 2015, and 2017, the problem persisted. This led to an extensive review involving 11 general insurers and 50 brands – representing a significant 68 percent of the Australian general insurance market.

These insurers were required to review any inconsistency between the pricing promises made to consumers and the promises delivered.

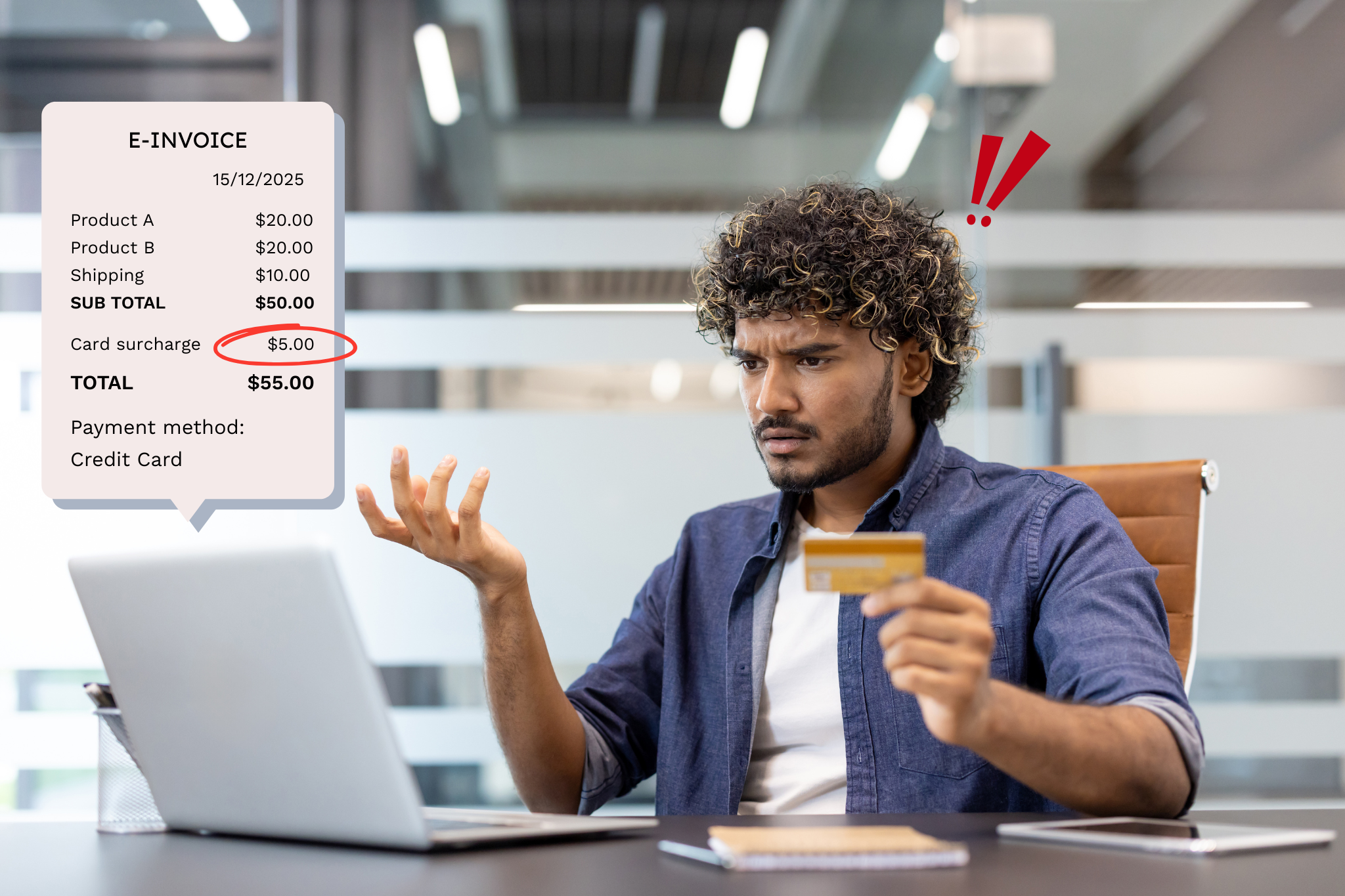

A 'pricing promise' is essentially a commitment by an insurer to offer a price-related benefit. This may be in form of discount, benefit or reward. These are commonly used to attract and retain clients. The review pinpointed that these promises were frequently broken, affecting over 5.6 million consumers across 6.5 million policies.

Which insurers are affected?

The insurers involved include:

| Name of general insurer (11) | Brands reviewed (50) | Estimated remediation |

Estimated number of policies |

Insurance Australia Group Limited (IAG), comprising:

|

Brands included:

|

$447.2 million | 4,254,000 |

| RACQ Insurance Limited | RACQ, Carpeesh, Famous, Honey, Hug, RACWA | $222.0 million | 759,000 |

| QBE Insurance (Australia) Limited | QBE, Chu, MBInsurance, Victor | $90.4 million | 746,000 |

| AAI Limited | AAMI, APIA, CIL, Shannons, Suncorp | $19.6 million | 165,000 |

| Allianz Australia General Insurance Limited (previously Westpac General Insurance Limited) | Westpac, BankSA, Bank of Melbourne, RAMS, St George | $13.2 million | 130,000 |

| The Hollard Insurance Company Pty Ltd | Woolworths, Arcadia, Fast Cover, Velosure, Real, Kogan, Medibank | $9.4 million | 256,000 |

| Youi Pty Ltd | Youi, Domain Insure, BZI | $4.6 million | 86,000 |

| Allianz Australia Insurance Limited | Allianz, Club Marine, TIO | $4.4 million | 36,000 |

| Auto & General Insurance Company Ltd | Budget Direct, ING Direct, Lady Driver, Qantas Insurance, Virgin Insurance | $3.9 million | 92,000 |

|

Hollard Insurance Partners Limited (previously Commonwealth Insurance Limited) |

CommInsure, Bankwest | $0.9 million | 14,000 |

| Total | $815.6 million | 6,538,000+ policies |

Of these, IAG and IAL owe the most – an estimated $447.2 million across 4,254,000 policies. On a per policy basis, however, RACQ leads the pack with around $292 owed for each policy.

What has ASIC told insurers they must do?

ASIC has outlined the following key requirements that general insurers must meet to comply with their legal obligations and reduce the risk of consumer harm.

Clear pricing promises

Insurers must use easy-to-understand language in promotions. They should disclose more, not less, about any factors that affect insurance premiums to ensure the disclosure is complete and meets community expectations. Insurers should also ensure that disclosures on price floors are well understood by consumers and that any representations are consistent with how the consumer’s premium is calculated.

Honesty in loyalty offers

Renewal communications must be accurate and promised loyalty rewards should be genuine. Insurers must also ensure any statement or representation that offers consumers a competitive price is not false or misleading.

Monitoring and oversight

Insurers must have robust systems in place to monitor and uphold their promises. They should collect and regularly review policy-level pricing data and use it to test their compliance. Also, insurers must have adequate oversight of third-party distributors to ensure consumers receive the promised discounts.

Product governance

Strong governance practices should be implemented. This should include using a centralised repository of pricing promises, and a regular review of products, to ensure that the pricing promises meet consumer expectations.

In addition, ASIC has initiated a process called FFRR - Find, Fix, Repay, and Report to hold insurers accountable for their pricing promises. First, insurers find differences between the prices promised to consumers and what they were charged. Then they fix the 'root cause' of the issue and relevant systems, processes, controls, and governance practices. Next, they repay affected consumers, and finally, insurers report significant or likely significant breaches to ASIC.

How are insurance companies responding?

In reaction to ASIC's findings, insurers are:

-

- Simplifying discount offers - They are revising pricing promises and updating consumer eligibility information, making it easier to deliver on their promises.

- Reviewing systems and processes - Insurers are reviewing what tools and procedures are used to administer pricing promises to pinpoint anomalies.

- Reviewing promotional material and disclosure documents - Insurers aim to provide consumers greater transparency on how they determine offer eligibility and deliver on pricing promises.

- Updating promotional material - Participating general insurers have updated more than 530 web pages and other promotional material to reduce complexity and clarify their insurance offerings and promotions.

- Revising disclosure documents - Insurers have revised or reissued 115 Product Disclosure Statements (PDS), policy documents, or other documents.

- Improving product governance - Several insurers are making improvements, such as more straightforward documentation of procedures and dedicated roles assigned for reviewing and approving pricing promises.

- Improving monitoring and oversight - Some are increasing resourcing in quality assurance and oversight roles in their business.

- Correcting pricing algorithms - General insurers are correcting errors in the pricing algorithms that charged consumers the wrong amount and are strengthening preventative and detective controls.

What does the finding mean for me?

If you have a policy with any insurer mentioned in the ASIC report, you could be due a refund. The exact amount will vary based on your specific policy.

How to get, and when to expect the refund

In most cases, you should not have to do anything to receive your refund. The insurers are required to identify any differences between the prices promised to consumers and what those consumers were charged. Then they should rectify these issues and repay affected consumers. This means the insurer should automatically calculate the amount you are owed and issue a refund if you are eligible. If you are unsure, you can contact your insurer for further clarification.

As for when you will receive the insurance refund, the report does not provide a specific timeline. However, identifying and rectifying pricing failures has been ongoing since October 2021, and the insurers are actively working to repay affected consumers.

Do I have to do anything differently in the future?

The ASIC report states that you should not be required to prove your eligibility for a pricing promise. Insurers should already hold the required information. Where possible, insurers should use data they already have to determine your eligibility for pricing promises and calculate premiums. This will avoid situations where you buy a product on the understanding that you are eligible for a discount, but the discount is not applied.

However, in some cases, insurers may place the onus on you to ask whether the multi-policy discount ‘may apply to other insurances’. They may require you to contact them for more information. Some advertising and disclosure documents are not clear. Some do not contain a complete explanation of the qualifications and exclusions that were intended to apply to the discount.

It is therefore important that you understand the terms of your insurance policies, especially given insurance policies are getting more innovative. If you need clarification on your eligibility for a discount or promotion, contact your insurer.

And if you aren’t sure whether or not you’re entitled for an insurance refund, lodge a complaint with us, and we’ll help you handle it.