Robodebt class action settlement: What you need to know

Thousands of Australians will benefit from the recent Robodebt class action settlement but to what degree and how will the funds be distributed?

The Australian Government announced last month that another $475 million would be paid to victims of Robodebt, which used automated income averaging to issue debt notices to more than 400,000 welfare recipients.

The debts were calculated using yearly income averaging from Australian Taxation Office (ATO) income, rather than fortnightly earnings, which was found to be illegal.

The decision came after the Federal Court approved the first Robodebt class action settlement – a record $1.8 billion – in June 2021. The Morrison Government had agreed to repay victims $751 million and wipe debts worth $1.76 billion, with victims to receive a portion of $112 million in interest.

Revelations at the 2022 royal commission, which handed down its report in July 2023, prompted Gordon Legal to appeal the first settlement. These included that the government knew Robodebt was illegal but continued to pursue welfare recipients anyway.

What happened with the first settlement?

Settlement of the first Robodebt class action was approved in June 2021, seven months after the Morrison Government agreed to refund money and wipe debts.

The subsequent settlement distribution scheme was administered by Services Australia, the government agency responsible for welfare payments, with eligible class action members receiving a portion of the interest payment by late 2021.

The scheme was divided into five categories, with only two categories eligible for settlement payments:

-

- Class members whose debts had been partly or wholly based on averaged ATO income and who had made a repayment toward those debts

- Those whose debts were initially based on the ATO information but later recalculated using payslips or bank statements, and they overpaid the recalculated debt

Class members who did not make payments on the averaged debt, did not overpay any recalculated debt or whose debts weren’t based on the averaged ATO income did not receive a settlement.

Settlement payments were calculated in a similar way to interest, using the interest rates set by the court and taking into consideration when the money was paid, how much group members paid and when they were refunded, as well as how many registered for a settlement payment.

What is the process for the new settlement?

The $475 million settlement must still be approved by the Federal Court. As per the previous settlement, it could be many more months before eligible group members are allocated their share.

Unlike the first settlement, however, compensation will be dispersed by a scheme administrator appointed by the Federal Court. Eligibility and payment amounts will be determined by the administrator.

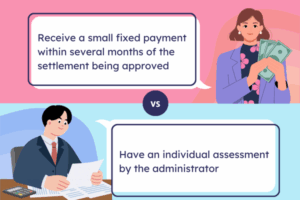

This time around, group members will have two options for payment. They can elect to:

-

- Receive a small fixed payment within several months of the settlement being approved; or

- Have an individual assessment by the administrator, applying compensation principles while considering litigation risks and the strengths and weaknesses of each claim

People who were in close personal relationships with group members who died as a result of Robodebt will also be able to make claims for compensation if they suffered a recognised psychiatric illness or condition.

The agreement also allows the court to determine separate amounts for the applicants’ reasonable legal costs, up to $13.5 million, while up to $60 million is set aside administering the settlement.

What should you do?

While it is not administering this settlement, Services Australia is encouraging all group members to ensure their address details are current. The agency will send notices to eligible members to explain how they can register to be part of the settlement.

If you were a group member for the first class action, you are likely to be party to the second. But it is important to register to ensure you are kept updated on the progress.

If the Federal Court approves the settlement, which Gordon Legal expects will take place within the next six months, you will receive notification about what to do next.