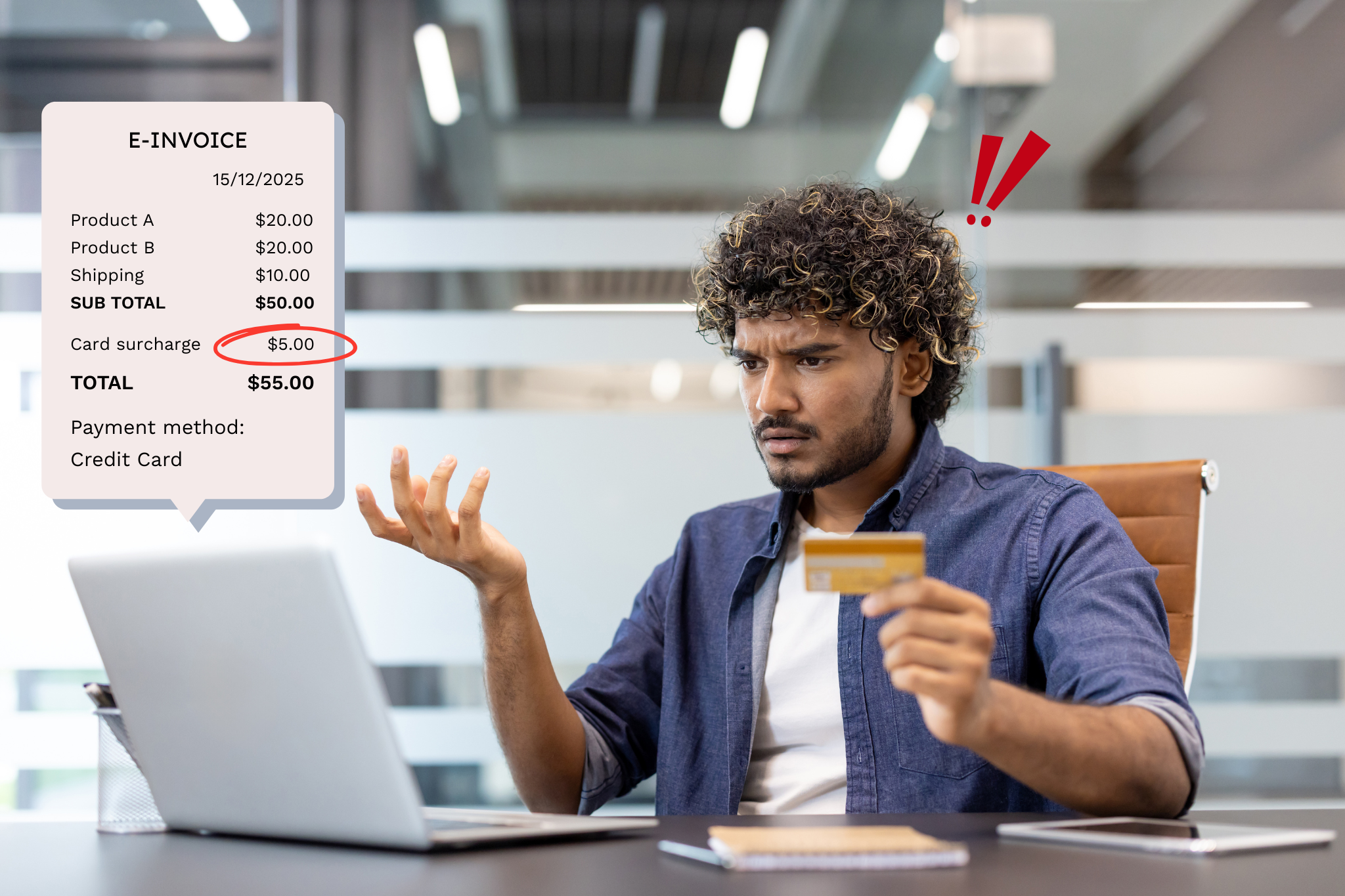

Has your card surcharge been supercharged?

Last updated on May 29th, 2025

We are so used to paying for everything by debit or credit card these days, many of us barely give any thought to the little extra that is often tacked onto the purchase price. But you should take a closer look to avoid being needlessly stung by card surcharges.

Businesses are entitled to pass on the fees they are charged to use electronic payment systems in the form of surcharges but there are rules governing what they can and can’t do. The Australian Competition and Consumer Commission (ACCC) has also been given $2.1 million to help clamp down on excessive surcharging as part of the Albanese Government’s planned overhaul of Australia’s payments system.

While the Government is looking to ban debit card surcharges by 2026, pending a review by the Reserve Bank of Australia (RBA), there is no need to wait until laws change to ensure you aren’t paying too much.

What to watch out for

Excessive surcharges

Australian law stipulates that businesses can only charge a surcharge equivalent to the payment processing cost. However, some companies may attempt to impose excessive fees.

Surcharges not disclosed until checkout

Some businesses might only disclose the surcharge once you're at the point of payment. This can make their prices seem lower than they actually are. Make sure to ask about any potential surcharges before you make a purchase.

Uniform surcharges for different cards

Some merchants might have the same surcharge for all card types, even though the cost of processing different types of cards can vary significantly. They are allowed to do this as long as the surcharge doesn't exceed the cost of the lowest-cost payment method.

Surcharges disguised as something else

In some cases, businesses might impose fees that are not explicitly labelled as surcharges but essentially serve the same function; that is, covering the costs associated with processing card payments. These disguised surcharges could take the form of handling fees, service fees or convenience fees. While the terminology differs, these fees still represent an additional charge imposed on customers who pay via card or specific payment methods. In that case, the regulations around surcharges - including the ban on excessive surcharges - should apply.

How to complain about a surcharge

Don't just grumble quietly if you believe you have been hit with an excessive surcharge. There are steps you can take.

Speak up

The first thing to do is voice your concerns directly with the business. It may be an oversight on their part or a misunderstanding on yours. Discussing the issue calmly and politely could lead to a quick resolution.

Gather evidence

If the business isn't helpful or refuses to change the surcharge, keep any receipts or other evidence of the transaction. Also, make a note of any surcharge warnings or signage displayed in the store or on the website.

Contact your bank

If you've paid with a card, contact your bank or credit card provider. They might be able to provide advice or assist in resolving the issue.

Report to the ACCC

If you're still not satisfied, you can report excessive payment surcharges to the competition regulator. The ACCC can investigate complaints and take action if it finds that a business is charging excessive surcharges.

Remember, it's not just about getting your money back but about ensuring that businesses are held accountable and that other consumers don't get overcharged. Standing up for your rights can help bring about change and ensure a fairer marketplace for all. There are also some simple ways you can help keep your card surcharges down.

Let us help you handle it

Next time you go to pay for something, take a closer look at the information near the till, and if there is nothing to advise you about the cost of using a card, ask if you’re paying a surcharge. If you think it’s excessive and would like the business to be more transparent about this extra cost, lodge a complaint with us, and we’ll help you handle it.